Written by Lim Tse Hwei and Chia Jia Ming

Summary of sweeping US tariffs

On 2 April 2025, US President Donald Trump announced a tariff hike on goods imported from other parts of the world into the United States of America, consisting of two parts:

- A unilateral baseline 10% on all imports to the US (implemented on 5 April 2025); and

- “Reciprocal” and country-specific tariffs, with rates purportedly assigned to each country based on the prevailing trade deficit between the US and that country (to take effect on 9 April 2025).

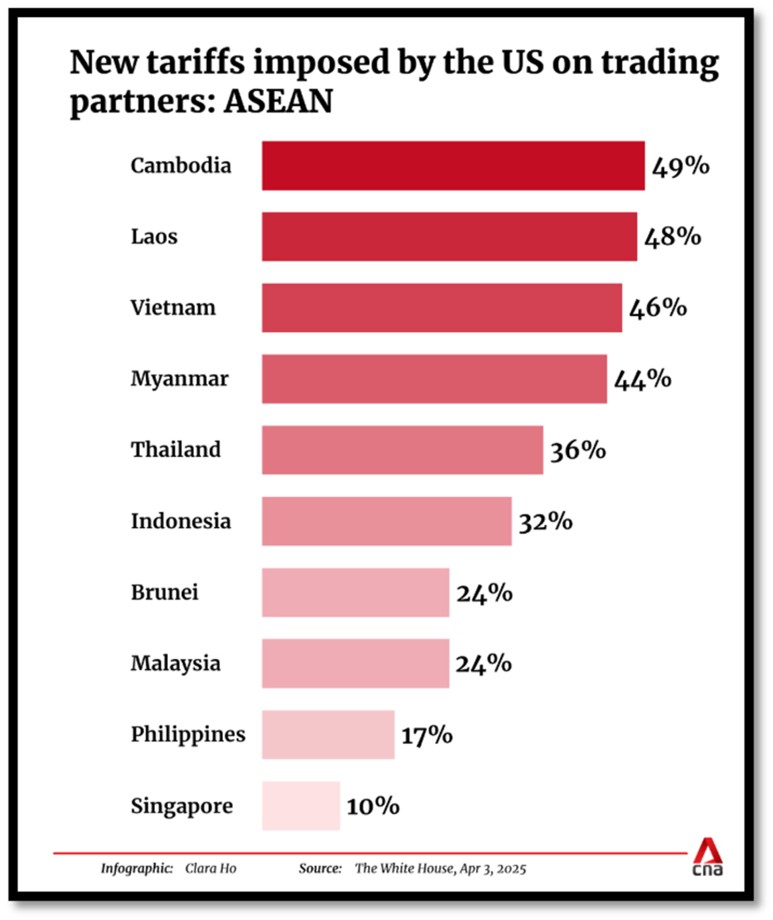

Malaysia was hit with a 24% tariff on its imports to the US, a significant increase from the previous 2.2% trade-weighted average tariff.

Goods in Annex II of the Executive Order here which are not subject to reciprocal tariffs include:

- Books, informational material, journals;

- Steel and aluminium imports (separately subjected to 25% tariffs);

- Foreign-made cars and key automobile parts (engines, transmissions, powertrain parts, electrical components) (separately subjected to 25% tariffs on 3 April 2025); and

- Copper, pharmaceuticals, semiconductors, lumber articles, critical minerals, energy products, certain electronic integrated circuits and parts.

25% tariffs on automobile parts are set to be implemented no later than 3 May 2025.

Challenges & impact on Malaysia

The US accounts for approximately 11.3% of Malaysia’s exports, with E&E to the US forming approximately 7.9% of Malaysia’s total exports. The US itself accounts for approximately 20% of Malaysia’s overall E&E exports.

Annex II of the Executive Order shows that semiconductors presently enjoy a narrow exemption from the reciprocal tax. However, goods which contain semiconductor chips are not on the list, and there is no guarantee that separate tariffs on semiconductors are not in the works.

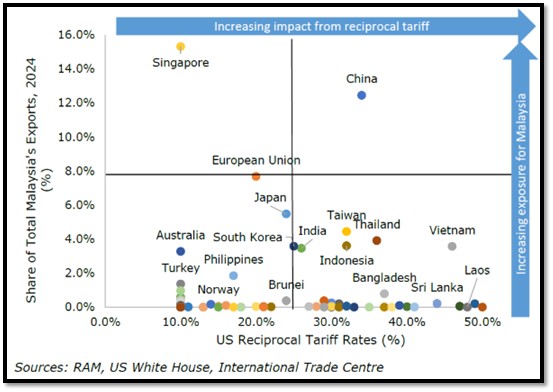

On the world stage, the US accounts for approximately 24% of the world’s imports. The tariffs will alter the fabric of international trade and possibly lead to a slowdown in global trade activity, especially as some of Malaysia’s trading partners are facing heftier increases in tariffs.

The foreseeable spill over effects on Malaysia from tariffs imposed on its trading partners are demonstrated below:

Malaysia will have to consider trade diversion to other trade partners, although it would be difficult to disengage from the US market. However, there may be opportunities for Malaysia to stand out as a more cost-competitive nation, compared to certain other Southeast Asian countries, who are on the receiving end of higher tariff rates:

How businesses can respond

Review and renegotiate contracts with trade partners

- As it is the importer who must legally account for import tariffs, do your contracts allow parties to mutually agree on a win-win mechanism to absorb the tariffs?

- Do your contracts allow for amendments and revisions? If so, how?

- Do your contracts allow for parties to mutually agree on price adjustments?

- Do your contracts specify what happens if there is a disruption that makes continuing the contract impossible (for example, a major disruption in supply)? Is the consequence more beneficial for you or for your trade partner?

- If termination of the contract becomes absolutely necessary, does the contract allow for it, and how should it be carried out?

Review and regularise employment

A slowdown in global trade and changes in investment trends may have an adverse impact on a company’s capacity to retain employees, especially in the manufacturing and E&E sectors. Considering Malaysia’s employee-centric position, these are questions companies and businesses should be asking employment law practitioners:

- Do your employment contracts allow you to reduce your employees’ working hours without exposing your business to claims of constructive dismissal?

- What are the cost reduction measures an employer must take under the law before considering retrenchment?

- When should a retrenchment exercise be considered?

- What are the alternatives to retrenchment?

- What is the current trend in the Industrial Court for the awarding of compensation and damages in unfair dismissal claims?

- Do any of your employment contracts need to be reviewed in light of the above?

Consider relocation, trade diversion and market diversification

As the Ministry of Investment, Trade & Industry (MITI) engages the US in negotiating the tariffs, businesses should keep an eye out for updates concerning incentives, exemptions and initiatives that the Malaysian government may put in place to reduce the impact of the tariffs. In the meantime, it would be prudent for businesses to consider relocation, trade diversion and market diversification, which would come with certain considerations:

- Risks and regulations in different jurisdictions;

- Rules of origin (how the origin of a product is determined) in order to make the most of preferential tariff treatment;

- Risk of investigations into duty evasion if production is relocated; and

- How to leverage existing free trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and Regional Comprehensive Economic Partnership (CPTPP).

Actively engage with professionals

The tariff announcement takes place barely a month before the Malaysian government implements changes to the Sale and Service Tax (SST) on 1 May 2025, which will purportedly affect 11,422 items. Businesses should engage tax professionals for a comprehensive overview of the impact of these changes to the business.

Published on 8 April 2025