Review Trade Agreements and Arrangements

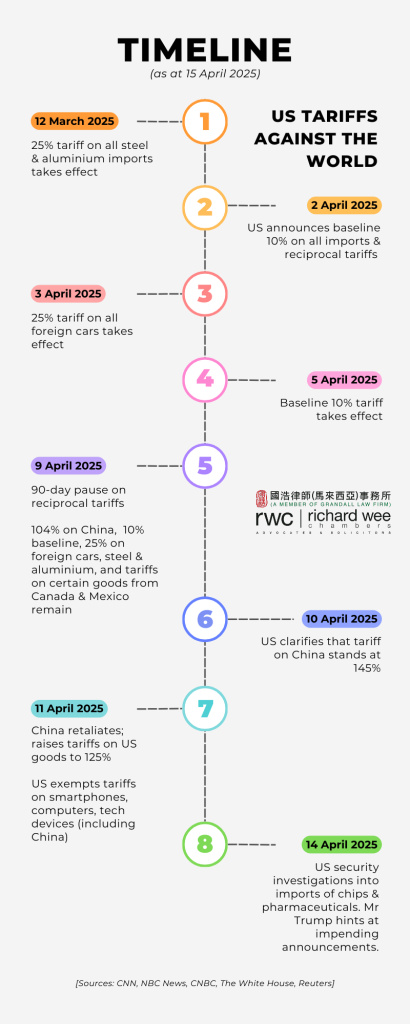

Whether the reciprocal tariffs on Malaysia remain at 24% after the 90-day pause is uncertain. However, what is certain is that businesses must accept new policies and reversals of policies as the new normal, until Mr. Trump achieves the goal behind the initiation of the tariffs, whatever it may be. Just this week, US President Donald Trump described the reprieve on semiconductors and tech devices as “temporary”, until the US is capable of producing the same items locally.

We addressed the impact of the tariff war on Malaysia and how businesses can respond in our previous article here. As policies continue to fluctuate in the tit-for-tat between the US and China, formulating short-term plans to deal with the tariffs is key.

In this article, we propose clauses in trade agreements which ought to be reviewed in order to navigate the uncertainties of the tariff war.

Although the burden of bearing the tariffs legally falls on the importer, the party exporting the goods are not completely unscathed. The importer may seek to negotiate a win-win solution, which would likely involve increased costs on the part of the exporter. It goes without saying that the exporter should diligently seek to review trade agreements if parties have agreed for the exporter to bear the burden of the tariffs.

What should businesses look for? What changes can be made that can be easily adapted to this constant state of flux? What kind of negotiations can businesses pre-empt?

The following sections have been framed in the form of questions so that businesses can assess existing trade agreements and particularise future agreements.

Clauses on Responsibilities and Allocation of Costs

“Who bears what?” by that, we mean:

- As parties are free to depart from Incoterms 2020, does the contract allocate responsibility for the tariffs to the exporter?

- Where are possible places in the contract that would allocate the tariffs to the exporter? What is the contract’s position on Incoterms that define the responsibilities of each party (Ex Works, FCA, FOB, CIF)?

Price Adjustment Clauses

- Is the price of goods fixed, or subject to changes in government and trade policies?

- Is the clause clear about the mechanism to adjust the price of goods if the correct conditions are fulfilled? For example, is there an applicable scale or ratio?

Exclusivity or Minimum Purchase Clauses

As the importer will face higher costs as a result of the tariff hike, the importer may begin looking elsewhere to mitigate the cost of obtaining similar goods or reduce orders in order to initiate negotiations.

- Does the contract state that the importer cannot source for the same or similar goods from a third party?

- Does the contract specify a minimum order that the importer must make? In other words, is your business at risk of facing a drastic reduction of orders?

- Is the importer allowed to suspend purchases? For how long? At what cost?

- If the contract provides enough space for the importer to manoeuvre, it would be prudent to prepare for negotiations in order to achieve a win-win solution. This may mean absorbing part of the tariffs.

“Material Changes” Clause

This clause allows parties to renegotiate or terminate the contract if a party’s position is negatively impacted by a material change. This clause is also known as the “Material Adverse Effect” (MAE) or “Material Adverse Change” (MAC) clause. While more commonly found in M&A agreements, businesses should consider including an MAC clause in future contracts in light of the uncertainty of the times.

Scope

- Is the clause clear enough to cover material changes in tariffs, sanctions, trade policies and government policies (import/export)?

- Does the clause specify that there must be a negative effect on the business, financial conditions, operations and liabilities of one or both of the parties?

Conditions to invoke clause

- How is the negative impact of the change measured? In other words, “How much is too much?” and “How long is too long?” If the clause is vague and unclear about the threshold to measure such loss, parties may find themselves at the mercy of the courts. [1]

- What would the party relying on it need to prove? What documents must be produced to prove that the business has been severely affected? Examples of documents that should be specified are financial statements, third-party valuations and verified data from the market.

Aftermath of trigger event

- What are the consequences of invoking the clause? Are parties allowed to negotiate an alternative course of action, or must the contract be terminated?

- Does the clause specify a timeframe for the alternative course of action? How long are parties allowed to negotiate, and when are negotiations deemed to have failed?

- If the contract must eventually be terminated, how is each party affected? What happens to payments that have been made, services that have been provided, or goods that have been delivered? Does one party need to compensate the other party? In other words, how do parties “wrap up” the relationship?

Force Majeure Clause

A force majeure clause is similar to an MAC clause – it excuses parties from performing their obligations under the contract when an event occurs unexpectedly and makes the contract impossible or impractical to perform. Examples of a force majeure event are usually set out in the same clause.

Scope

- Does the clause clearly include material changes in tariffs, sanctions, trade policies and government policies (import/export)? Unless the clause is clear, it is unlikely that an importer would be successful in relying on it in this situation, as the tariff hikes make trade more expensive, but not impossible.

- Does the contract allow parties to amend the clause to include the situations mentioned above?

Conditions to invoke clause

- What is the trigger event to invoke the clause?

- What does the clause say about how long the force majeure event must carry on, or what the party relying on it must do before the contract is no longer capable of being performed? For example, most force majeure clauses would state that the parties must first make “reasonable efforts” to overcome the force majeure event.

- What amounts to “reasonable efforts”? Does it include accepting alternatives outside the contract? [2]

- Is there a specific timeframe for a party to notify the other party that they intend to take the tariffs as a force majeure event?

Aftermath of trigger event

- The same questions under an MAC clause apply.

Conclusion

Businesses make commercial decisions; lawyers assess the legality of commercial decisions.

After businesses conduct internal mapping (cost analysis etc), external mapping (through market intelligence), and identify their key priorities in adapting to the current trends, business owners should then take their agreements to corporate lawyers for a review of the key clauses highlighted above.

[1] For example, in the case of BM Brazil Ors v Sibanye BM Brazil Anor [2024] EWHC 2566, the Commercial Court of England considered losses of $20 million insignificant, constituting only 5% of the $525 million purchase price for the mine. The party should suffer a reduction of at least 15% in equity for it to be material.

[2] In the UK Supreme Court case of RTI Ltd v. MUR Shipping BV [2024] The UKSC 18, RTI refused MUR Shipping’s force majeure clause and offered to pay MUR Shipping in Euros instead of US Dollars, as stated in the contract. MUR Shipping refused. The UK Supreme Court held that MUR Shipping was entitled to do so, and that refusal did not negate the force majeure notice. “Reasonable endeavours” do not include accepting non-contractual performance.

Sources

- CNN Business, “US stocks, dollar tumble as Trump’s trade war rattles Wall Street” (10 April 2025)

- NBC News, “Tariff Timeline: How Trump turned global trade into an economic battlefield” (15 April 2025)

- CNBC, “Trump exempts phones, computers, chips from new tariffs” (12 April 2025)

- The White House, “Clarification of Exceptions under Executive Order 14257 of April 2, 2025, as Amended” (11 April 2025)

- Reuters, “Tariffs on imported semiconductor chips coming soon, Trump says” (14 April 2025)

- Dentons, “Navigating tariffs – regulatory considerations and contractual safeguards” (8 April 2025)

**At the time of publication, the US has announced that China will face up to 245% tariff on imports. Details to follow.